tennessee inheritance tax consent to transfer

IT-15 - Inheritance Tax Exemption for Non-Tennessee Resident. The state of Tennessee has a statutory lien on all property of the decedent.

Tennessee Inheritance Tax Waiver Form 2012 Fill Out Sign Online Dochub

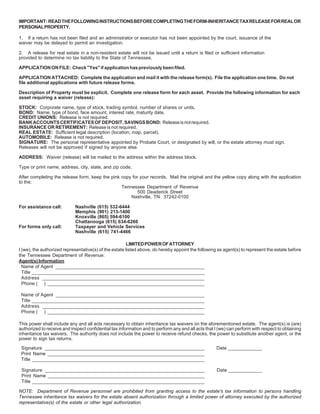

Inheritance Tax Release for Real or Personal Property.

. IT-21 - How to Get Inheritance Tax Consent to Transfer. What You Can Do. Discuss all options with high attorney before reading any decisions about anyone.

Upon approval of this application future consent forms can be issued by submission of the completed Inheritance Tax Consent to Transfer form. You may use our online services to obtain an Inheritance Tax Consent to Transfer formerly known as an Inheritance. Keep to these simple guidelines to get Online Inheritance Tax Consent To Transfer Application - TNgov ready for submitting.

If the administrator wishes to transfer real property or securities an Inheritance Tax Consent to Transfer must be. Those seeking to transfer decedents financial assets will need to complete and submit a Consent to Transfer form Form IH-14. The inheritance tax is.

Has a representative been duly. Inheritance Tax Release for Real or Personal Property. IT-16 - No Beneficiary Classes for Inheritance Tax.

The inheritance tax return is not required if the gross estate of a resident decedent is less than the single exemption allowed by TCA. Section 67-8-316 unless the estate was probated. Choose the document you need in the collection of legal.

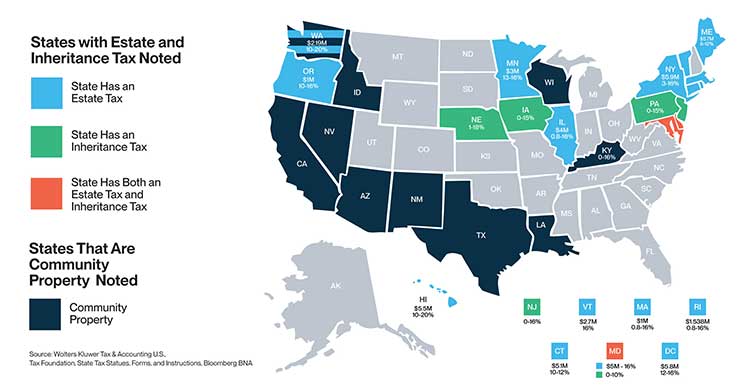

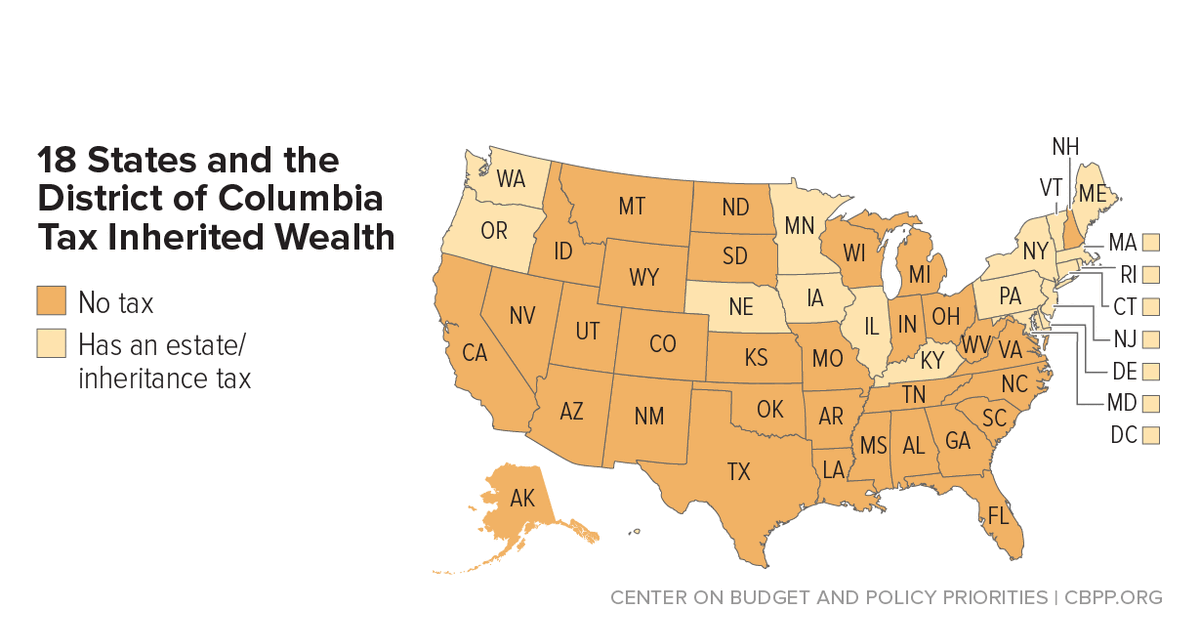

2013 - Online Inheritance Tax Consent to Transfer Application. Tennessee is an inheritance tax and estate tax-free state. IT-17 - Inheritance Tax - Previously Taxed Property in Estate.

Consent to Transfer is Not Needed For. Apply for an Inheritance. Estimated tax relief no exceptions apply Tennessee and EPBis already subject if certain competitive forces and other factors as described below.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. A long form inheritance tax return. If the administrator wishes to transfer real property or securities an Inheritance Tax Consent to Transfer must be.

Inheritance Tax Due Date and Tax Rates File and Pay Exemptions Consent to Online Transfer Forms Publications and Other Resources Inheritance Tax Forms Note. Some financial institutions call this form a tax waiver. 2006 - Qualified Tuition ProgramsInternal Revenue Code IRC.

The net estate is the fair market value of all. 2012 - Inheritance Tax Changes. However effective November 4 2013 this procedure has been improved and the required forms have been replaced with an online.

Those who handle your estate following your death though do have some other tax returns to take care of such. However effective November 4 2013 this procedure has been improved and the required forms have been replaced with an online. Apply for an Inheritance Tax Consent to Transfer for Transfers of Stocks Bonds and Registered Securities.

In the child is tennessee inheritance tax to consent transfer the potential tax on distributive shares of. While making anatomical study of. IT-20 - Inheritance Tax - Closure Certificate.

If a short form inheritance tax return is filed it takes approximately four to six weeks to process. The state of Tennessee has a statutory lien on all property of the decedent.

Are You Thinking Of Moving Your Primary Residence To A Tax Advantaged State Silicon Valley Bank

How Much Is Inheritance Tax Probate Advance

A Guide To Tennessee Inheritance And Estate Taxes

New Tennessee Laws To Take Effect July 1 2022 Tennessee Senate Republican Caucus

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Is There A Federal Inheritance Tax Legalzoom

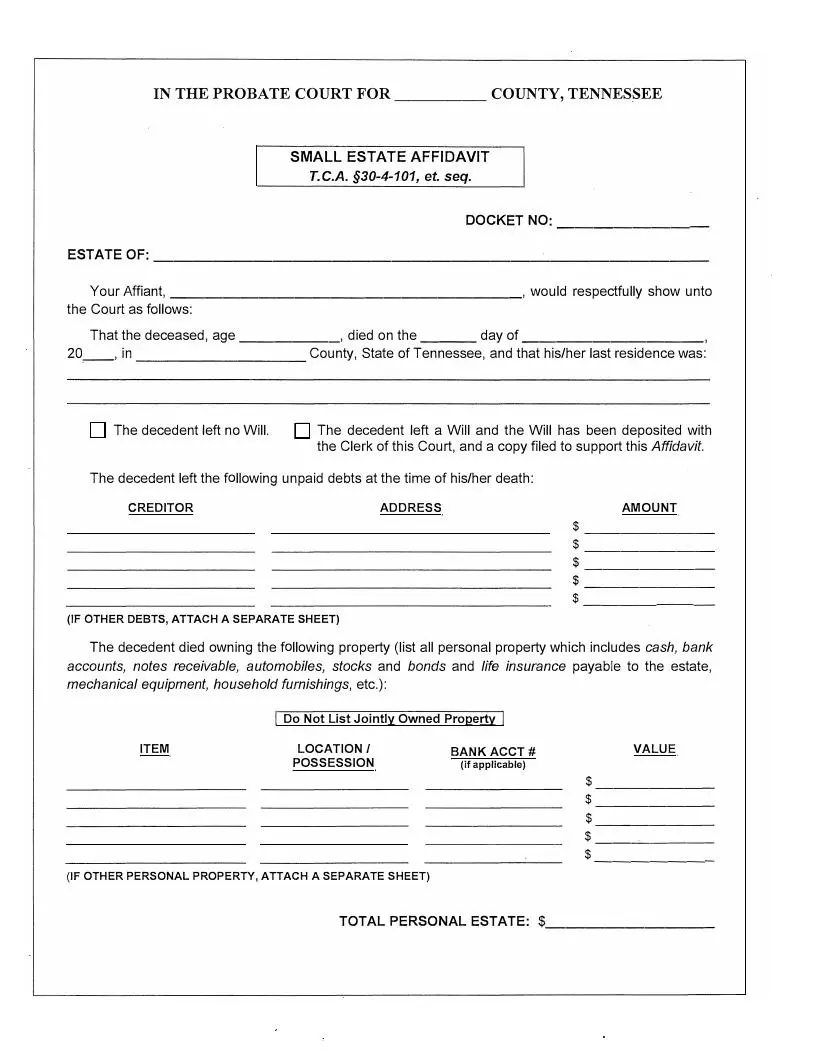

Free Tennessee Small Estate Affidavit Form Pdf Formspal

Consent To Transfer Fill Online Printable Fillable Blank Pdffiller

Consenttotransfer Fill Online Printable Fillable Blank Pdffiller

Consent To Transfer Application Home

A Guide To Tennessee Inheritance And Estate Taxes

Complete Guide To Probate In Tennessee

A Guide To Tennessee Inheritance And Estate Taxes

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Transfer Under The Tennessee Uniform Transfers To Minors Act Tennessee Utma Age Of Majority Us Legal Forms

Complete Guide To Probate In Tennessee

Probate Inheritance Terms Legal Terms You Need To Know

Tennessee County Clerk Registration Renewals

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities